- SMALL BUSINESS BOOKKEEPING SOFTWARE WITH INVENTORY FULL

- SMALL BUSINESS BOOKKEEPING SOFTWARE WITH INVENTORY PROFESSIONAL

The accrual method is a bit more difficult, in that your bank statements might not reflect the amounts on your income sheet. Recording just the cost of those supplies with the cash method might give you an inaccurate picture of how much you are - or should be - spending on supplies. Maybe you ordered some supplies but didn’t end up using them. This method also doesn’t account for inventory loss. That said, the cash method also has the potential to be slightly misleading - if you were late on a bill payment one month, for example, your records might end up showing a large sum paid for utilities one month, and nothing at all another month, leading to confusion. By recording cash transactions when the money actually changes hands, you can simply cross-reference your bank statements with your bookkeeping records to ensure accuracy. The cash method of bookkeeping is undeniably easier. So, which of these methods should you use in your bookkeeping to get the best, most accurate picture of your spending habits? That may depend on the size and complexity of your business.

In the accrual method, on the other hand, you would record the expense in January, on the date that you received the invoice - regardless of when you ended up paying for the parts. So, even though you received an invoice in January, you’d record the expense as a cash transaction in February, on the date that it was paid. In the cash method of accounting, you record the transaction only when the money has actually changed hands. However, you don’t actually pay the fee until you’ve received the parts, in February. You ordered the parts in January, and the manufacturer sent you an invoice that same month. Say you ordered some new machine parts from a manufacturer. To understand the difference between these two methods, take this example. Any company that must highlight cash flow retained earnings, or any other changes in a position financially must use a double-entry accounting system.īoth the single-entry and double-entry methods can work in tandem with cash or accrual bookkeeping. This inability to conform to GAAP’s requirements may not apply to very small businesses which only need to be able to illustrate a method of meeting reporting requirements for taxes and employees. Keep in mind, single-entry bookkeeping’s simplicity doesn’t allow for GAAP conformation. With the help of cloud accounting software for small-business bookkeeping, you can pretty much automate the process.

Plus, it’s really not that much more complicated. The double entry method leaves less room for error, making it the better choice for balancing complex books. However, if your business is incorporated, or if it’s your sole source of income, the single-entry method just won’t cut it.

SMALL BUSINESS BOOKKEEPING SOFTWARE WITH INVENTORY FULL

For example, if you work full time but have a side business selling handmade jewelry, single-entry bookkeeping is probably enough to record your profits and expenses from that side business, so you can claim the amounts on your taxes. This can be sufficient for very small businesses that aren’t incorporated. Single-entry bookkeeping is simpler - you only have to record each transaction once.

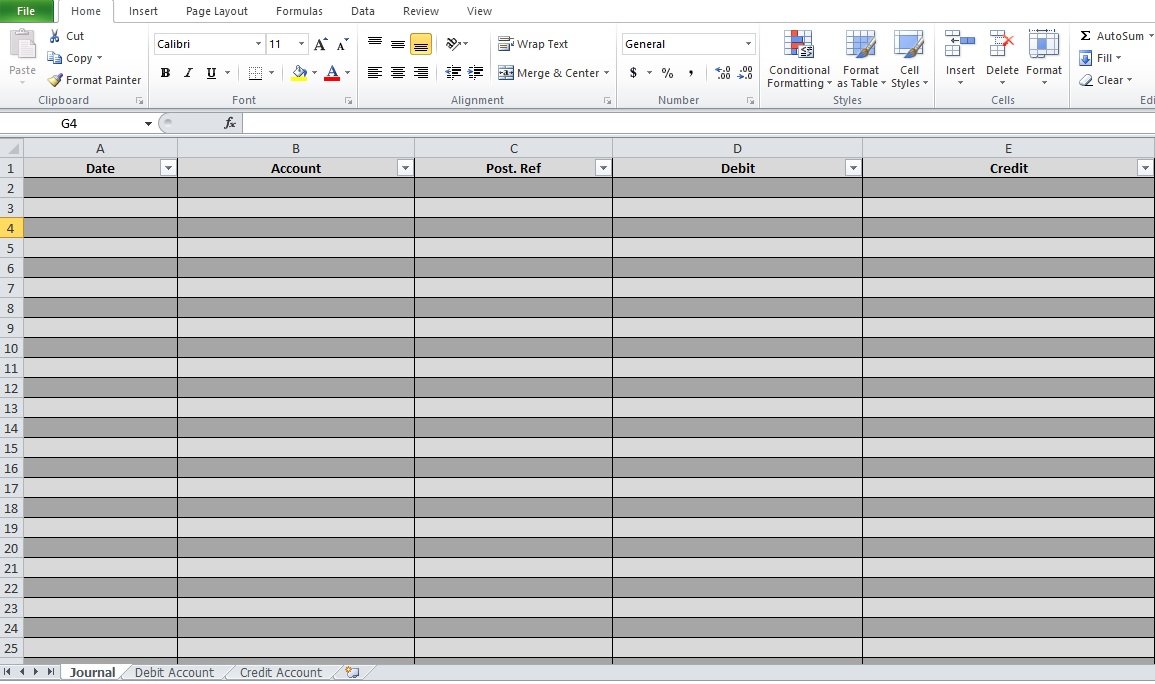

For example, if you make a $30 sale, in the double-entry system that transaction could be recorded as a gain in your income ledger, and as a deduction to the total value of your inventory. In single-entry bookkeeping, each transaction is recorded as a single entry in a ledger, while in double-entry bookkeeping, a transaction is recorded twice. What is the Difference Between Single-Entry and Double-Entry Bookkeeping? For digital records, QuickBooks allows you to easily delete or condense historic transaction data to save you storage space and secure sensitive financial information.

SMALL BUSINESS BOOKKEEPING SOFTWARE WITH INVENTORY PROFESSIONAL

Records older than six years can be securely disposed of by hiring a professional document shredding company. Making sure your records are well-organized can save you a big headache if you’re ever subjected to an audit.Īs a business owner, you’re required to keep financial and tax records for six years after the tax year in which they were received it’s a good idea to keep these archived records in both paper and digital formats for added security. Saving your records in the cloud also ensures that they’re easily accessible in a digital format from any device. Take the time to organize your records, whether that means buying a filing cabinet or breaking out the label maker. An obsession with documentation is a good trait to have as a small business owner.

0 kommentar(er)

0 kommentar(er)